Introduction to Bitcoin Forks

Bitcoin forks are an integral part of the cryptocurrency ecosystem, often misunderstood yet vital for its evolution. A fork occurs when changes are made to the blockchain protocol or its rules, leading to a split in the network. This divergence can result in the creation of a new cryptocurrency or simply a protocol update. Forks are essential to addressing scalability, security, or operational improvements in Bitcoin, ensuring the currency remains adaptable to the ever-evolving technological landscape. Additionally, forks enable the integration of innovative features that keep Bitcoin competitive in the broader financial market. For beginners, understanding forks provides insight into the democratic and decentralized nature of blockchain governance.

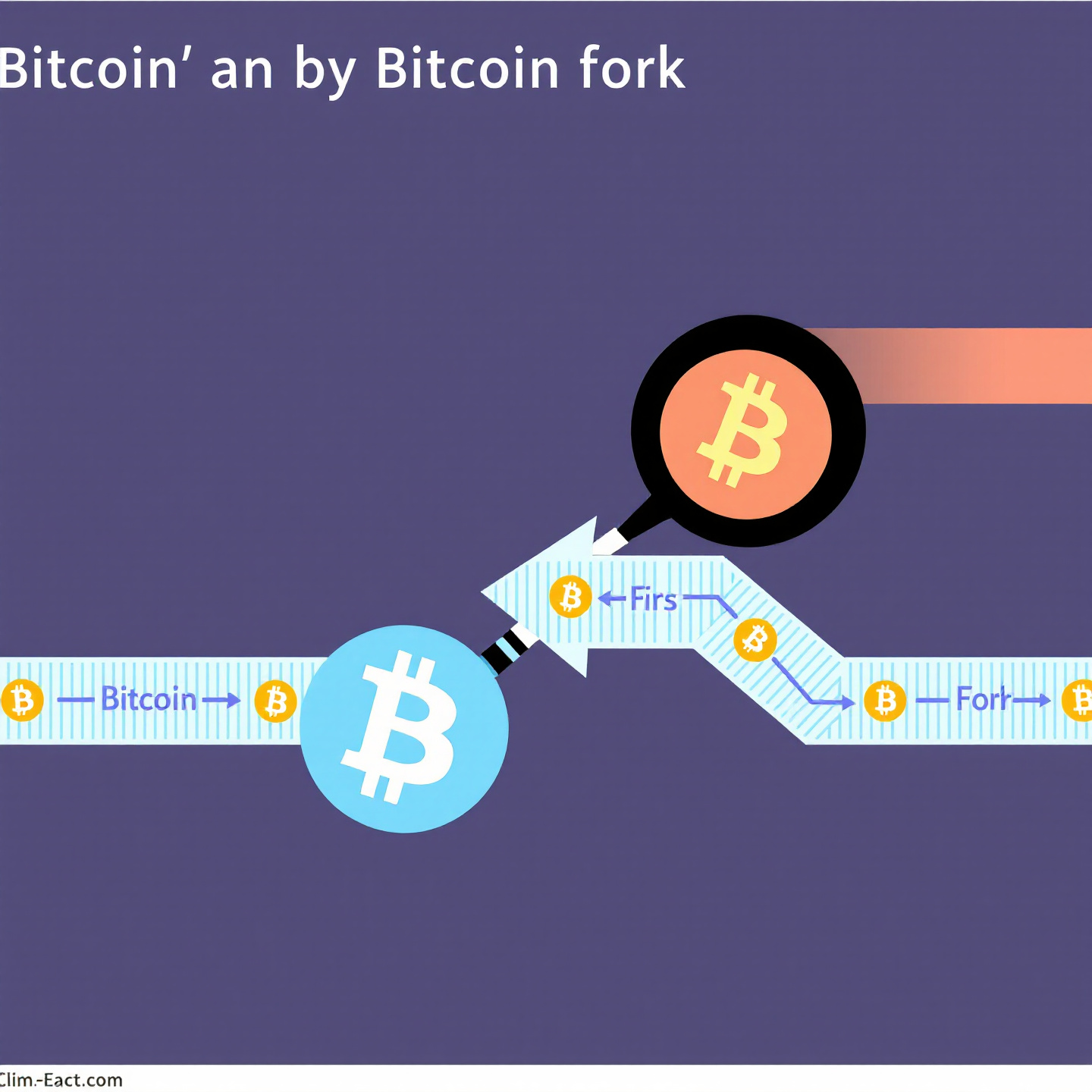

Hard Fork vs. Soft Fork: Key Differences

Forks are classified into two types: hard forks and soft forks. A hard fork creates a new version of the blockchain that is incompatible with the previous one, necessitating that all nodes and miners upgrade to the latest protocol. Soft forks, on the other hand, are backward-compatible, meaning updated nodes can coexist with older ones. While hard forks often lead to the birth of new cryptocurrencies, soft forks serve as protocol upgrades without causing a network split. For instance, SegWit (Segregated Witness) is a well-known soft fork that improved Bitcoin’s scalability by altering how transaction data is stored. Understanding the distinctions helps stakeholders make informed decisions during these pivotal moments in blockchain evolution.

Reasons for Bitcoin Forks

Bitcoin forks occur for a variety of reasons, including disagreements among developers, the need for scalability solutions, or attempts to introduce new features. Some forks are community-driven, aiming to address inefficiencies or perceived shortcomings in the original protocol. Others emerge from opportunistic motives, such as creating a new cryptocurrency for financial gain. Regardless of the motivation, forks are a natural outcome of Bitcoin’s decentralized structure. For example, disputes over transaction speed and block size limits were key factors behind the Bitcoin Cash fork. These events demonstrate how innovation and conflict often go hand-in-hand in the cryptocurrency world.

Major Bitcoin Forks in History

The history of Bitcoin is marked by several significant forks. One of the most notable is Bitcoin Cash (BCH), created in 2017 due to disagreements over block size limits and transaction speeds. Another major fork is Bitcoin SV (BSV), which split from Bitcoin Cash in 2018 to further increase block sizes. These forks illustrate how ideological differences within the community can lead to permanent splits in the network. Lesser-known forks, like Bitcoin Gold (BTG), were launched to make mining more accessible by removing the dependency on specialized hardware. Each fork adds a layer of complexity to the Bitcoin narrative, showcasing its adaptability.

Impact on the Cryptocurrency Market

Bitcoin forks can have profound effects on the cryptocurrency market. They often generate volatility as investors speculate on the value of the new and original currencies. Forks also introduce competition, as the new blockchain attempts to establish itself alongside Bitcoin. For traders, understanding the implications of forks can provide opportunities for profit or loss depending on market dynamics and adoption rates. Additionally, forks often bring heightened media attention, further influencing market behavior. For long-term investors, forks can signify innovation but also highlight the inherent risks of a rapidly evolving asset class.

Technical Challenges and Solutions

Forks present technical challenges, particularly around consensus and network stability. Incompatibility between nodes can lead to orphaned blocks, where some transactions are rendered invalid. Developers mitigate these issues by carefully planning and implementing changes, often conducting testnets and community consultations before launching a fork. These measures aim to minimize disruption and ensure a smooth transition. For instance, implementing replay protection has become a standard practice to avoid transaction duplication across chains. Technical foresight is essential to preserving trust in the blockchain ecosystem during these transitions.

The Role of Community Consensus

Community consensus plays a crucial role in the success of any fork. Bitcoin’s decentralized nature requires broad agreement among stakeholders, including developers, miners, and users. Without sufficient support, a fork may fail to gain traction, leading to its eventual obsolescence. Successful forks like Bitcoin Cash demonstrate the importance of community alignment and effective communication. Conversely, poorly managed forks highlight the risks of division, emphasizing the need for transparent and inclusive decision-making processes. Engaging the community early can help ensure smoother transitions and broader acceptance.

Security Implications of Forks

Forks can introduce security risks, such as replay attacks where transactions on one chain are duplicated on another. To combat this, developers implement replay protection mechanisms to prevent cross-chain vulnerabilities. Additionally, the division of hash power between chains can make both networks more susceptible to attacks. Maintaining a balanced and secure ecosystem is a critical consideration during a fork. Beyond technical measures, education campaigns can help users navigate security concerns, further bolstering the community’s resilience to threats.

How Forks Affect Bitcoin Holders

Bitcoin holders are directly impacted by forks, as they often receive an equivalent amount of the new cryptocurrency if they control their private keys. This process, known as “airdropping,” can be financially rewarding. However, users must exercise caution, as claiming new tokens may expose their wallets to potential phishing attacks or scams. Understanding the technical steps to safely navigate a fork is essential for investors. Platforms like Ledger and Trezor often release detailed guides to assist users during forks, emphasizing the importance of informed participation in the crypto ecosystem.

Adoption and Longevity of Forked Coins

The success of forked coins depends heavily on adoption rates and long-term viability. Factors such as developer commitment, network security, and community support determine whether a new cryptocurrency thrives or fades into obscurity. Forks like Bitcoin Cash and Bitcoin SV have established themselves as major players, while others have struggled to gain a foothold in the market. Partnerships and integrations with exchanges often play a decisive role in a forked coin’s trajectory. Monitoring these factors can provide insights into the future potential of emerging cryptocurrencies.

Legal and Regulatory Considerations

Bitcoin forks often raise legal and regulatory questions, particularly around taxation and intellectual property. For instance, some jurisdictions treat forked coins as taxable events, requiring holders to declare and pay taxes on their value. Developers may also face legal challenges if forks violate existing patents or trademarks. Navigating these complexities requires a thorough understanding of applicable laws. Recent cases, such as those involving forked coins in the U.S., highlight the growing scrutiny regulators place on these events, emphasizing the need for compliance and transparency.

Conclusion: The Future of Bitcoin Forks

As Bitcoin continues to evolve, forks will remain a vital mechanism for innovation and adaptation. While they can create challenges, they also offer opportunities to address the network’s limitations and experiment with new features. For investors, developers, and users, understanding the dynamics of forks is crucial to navigating the cryptocurrency landscape effectively. Staying informed and engaged with the community will ensure a more secure and prosperous future for all stakeholders. Ultimately, forks exemplify the flexibility and resilience of decentralized systems in responding to the demands of a global, digital economy.